Last week, the government announced a temporary stamp duty holiday on the first £500,000 of all property sales in England and Northern Ireland in a bid to boost the property market and encourage uncertain buyers in the wake of the coronavirus pandemic. The raised tax threshold has come in with immediate effect and will remain in place until the close of March 2021. But what does this mean in practice? And more importantly, what does this mean for you? We take a look at how the new measures will impact first-time buyers, second home purchasers, and buy to let landlords.

What is stamp duty?

Traditionally, stamp duty, or Stamp Duty Land Tax (SDLT), is a tax paid if you buy a residential property or piece of land in England and Northern Ireland. Prior to Chancellor Rishi Sunak’s Summer Statement, stamp duty applied to homes sold for more than £125,000, or properties sold for more than £300,000 if you were a first time buyer.

The rate at which you will be required to pay the tax will depend on a number of different factors including where the property is located within the UK, the price of the property, and the property type i.e. whether the property is for residential or commercial purposes.

Elsewhere in the UK, namely Wales and Scotland, this works slightly differently; buyers in Wales pay Land Transaction Tax, whilst Scottish purchasers are required to pay the Land and Buildings Transaction Tax.

As such, the recent changes announced on the 8th of July will only apply to property buyers in England and Northern Ireland.

How has stamp duty changed?

The government has raised the tax threshold to £500,000 effective from the 8th of July, underlining the key role the government sees UK property playing in the country’s post-coronavirus recovery.

Chancellor Rishi Sunak has suggested the average stamp duty bill will now fall by £4,500, with almost nine out of ten homebuyers paying no stamp duty at all before the end of next March.

As a result, buyers are now in a better position to take out a mortgage as the reduction in stamp duty allows them to place a larger deposit. At the same time, sellers are more likely to be encouraged to go to market as buyers will theoretically have more money to spend during the holiday period, meaning more properties will be available on the market.

In fact, LDN Finance Director Anthony Rose has already noticed the incentive boost the new measures have inspired, commenting that “LDN Finance are already experiencing a surge of enquiries and clients who are now in a position to transact where they were not able to previously.”

Another surprising benefit to come from the announcement was handed to buy to let investors, as the changes will also apply to landlords who expand their property portfolios or incorporate as a lettings business. Property investors and second homeowners must however continue to pay a 3% surcharge on purchases, as before, but can now take advantage of paying no further stamp duty on the first £500,000 of any purchase.

What do the changes mean for you?

First-time buyers

Previously, first-time buyers were not required to pay stamp duty when they purchased homes up to a value of £300,000 – providing an advantage over other buyers whose threshold was set at £125,000 – and were offered reduced rates on purchases up to £500,000.

While the majority of UK first-time buyers purchase homes less than £500,000, those living in more expensive areas of the UK, such as London and the South East, often buy property above this amount and so were previously unable to take advantage of the lower rates of stamp duty for first time buyers. As such, LDN Finance Director Anthony Rose said that those looking to buy in London will now stand to benefit the most: “In London, a lot of first time buyers will still purchase above £500k, so this is a great improvement for them and doesn’t change their position versus home movers and investors. For those below this level, it will put them in a position where they will lose previous advantages they may have had which could take away their competitive edge but, taken in the whole, this has to be looked at as the right move for the market at this very difficult time.”

Before the government’s announcement, buying a property worth £550,000, for example, would have equalled £17,500 in tax. First-time buyers can now benefit from lower taxes as the same property would only incur a tax bill of £2,500. But all is not lost for those who are looking to purchase a first home under £500,000. Previously, first-time buyers looking to buy a home worth between £300,001 and £500,000 were charged 5% on the value of the property above £300,000, whereas they are now exempt from stamp duty tax entirely.

Are you searching for a first-time buyer mortgage and want to see how much tax you will be required to pay? Find out using our Stamp Duty Calculator.

Find out more about first-time buyer mortgages

Buy to let investors and second home purchases

Chancellor Sunak’s extension of the stamp duty holiday to buy to let investors has come as a welcome surprise, considering the higher rates of taxes and restrictions placed on investors borrowing in recent years. Property investors who purchase through limited companies will now also be exempt from stamp duty on properties with a value up to £500,000, however, the pre-existing 3% surcharge will still apply. This will also be the case for other buyers who are purchasing an additional property, such as second home buyers or those looking to buy a holiday home. In practice, this means that an investor or second home buyer purchasing a property valued at £500,000 will now be required to pay £15,000 as opposed to the previous £30,000 rate of total duty payable.

In view of the stamp duty changes for buy to let investors, LDN Finance Director, Anthony Rose, commented on how buy to let landlords will look to take advantage of the tax cuts and expand their property portfolios. “The stamp duty changes brought in by George Osborne have greatly curtailed landlord purchase activity in years gone by. As the stamp duty holiday will benefit them in the same way as other buyers, I think this will definitely bring a rush of enquiries from landlords who look to take advantage of this.”

The buy to let and second home tax rates are tiered just like residential rates and income tax. You can find out more about the current buy to let stamp duty rates for UK investors and second home buyers and how much you’ll pay with our Stamp Duty Calculator.

Are you a buy to let investor looking to expand your property portfolio? At LDN Finance, our experienced buy to let mortgage advisers take the time to fully understand your complete financial situation, before recommending an appropriate finance solution. This could involve using personal income to cover any shortfall in the rental income requirement set by mortgage lenders or alternatively, purchasing within a limited company structure to take advantage of the new changes. Ultimately, as a valued LDN Finance client, we can help to unlock new and efficient buy to let mortgage opportunities.

Find out more about buy-to-let mortgages

How much is stamp duty now?

If you are searching for a first-time buyer mortgage, looking to purchase a second home or want to expand your property portfolio as a buy to let investor, you can use our helpful calculator for an accurate understanding of what you’ll need to pay in wake of the government’s new stamp duty holiday.

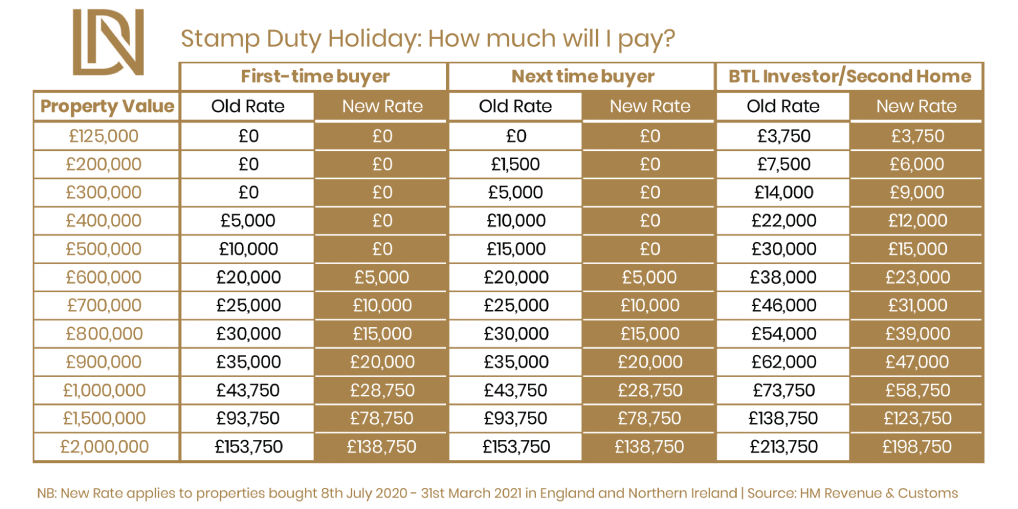

Alternatively, take a look at the infographic below for a comparison of old and new rates following the changes:

How LDN Finance can help

If you’re looking to capitalise on the recent stamp duty holiday and purchase a new property, LDN Finance can help – no matter the complexity. Our expert brokers have a wealth of experience in securing mortgages of all sizes for first-time buyers, home movers, and seasoned property investors alike. Working closely with our trusted network of mainstream lenders, private banks, and specialist financial institutions, we will secure the perfect mortgage arrangements to suit your circumstances at competitive, market-leading rates.

Get in touch with us

Get in touch with us today and we will assign you with a personal mortgage adviser who will guide you through the entire mortgage and property-buying process.